Capital Budgeting Assignment Help

Why us for Capital Budgeting Assignment help?

Capital Budgeting Analysis is one of the Core areas of Finance which is used by the Investor as well as Top Management to analyze and take decision for the purpose of Decision making. The meaning of Profit is different for Different types of investors. For Instance:

Capital Budgeting Analysis is one of the Core areas of Finance which is used by the Investor as well as Top Management to analyze and take decision for the purpose of Decision making. The meaning of Profit is different for Different types of investors. For Instance:

For an Equity Shareholder, Profit is the earning available after payment of all types of Interest, Taxes, Dividend and Expenses.

For a Preference Shareholder, Profit is the earning available after Paying Interest, Taxes and Expenses.

For a Debenture holder, Profit is the earning available after paying Taxes and Expenses.

For an Economist, Profit is the earning available after paying all expenses (EBIT).

This make us very tough to analyze and take decision based on the Profitability of the Organization as there is no clear meaning of Profit. Therefore Capital Budgeting Analysis is one of the process of taking investment decision based on the Cash Flow of the organization. The meaning of Cash Flow is common to all types of Investors i.e. Preference Shareholders, Economist, Debenture holders as well as Shareholders. It is because of so much complexity student find it difficult to solve this problem and look for capital budgeting assignment help. We have best experts to help students in their capital budgeting homework help. All our experts are dual degree holders and have good experience in fulfiling the requirements of students looking for capital budgeting homework help.

Services We Offer

Popular Capital Budgeting Assignment help Online Services

Capital Budgeting always put student on worries and stress. But with Assignment Consultancy for your help, you can remove all your worries by going through our various services:-

- Capital Budgeting Homework help

- Capital Budgeting Research Writing Help

- Capital Budgeting Thesis Writing Help

- Capital Budgeting Dissertation Writing Help

- Capital Budgeting Exam Help Online

- Capital Budgeting Online exam help

- Capital Budgeting Online Test Help

- Capital Budgeting Coursework Writing Help

- Capital Budgeting Essay Writing Help

- Capital Budgeting Assignment Topics and Idea

- Capital Budgeting Case Study Help

- Capital Budgeting Numerical Help and Solutions

- Capital Budgeting Excel Analysis Help

Features

Features for Capital Budgeting Assignment Help Online

We believe in providing no plagiarism work to the students. All are our works are unique and we provide Free Plagiarism report too on requests.

Our customer representatives are working 24X7 to assist you in all your assignment needs. You can drop a mail to assignmentconsultancy.help@gmail.com or chat with our representative using live chat shown in bottom right corner.

We are the only service providers boasting of providing original, relevant and accurate solutions. Our three stage quality process help students to get perfect solutions.

All our works are kept as confidential as we respect the integrity and privacy of our clients.

Testimonials

Our Testimonials

Mike Phil, Student , UK University

“Great Experts to provide real time capital budgeting help services. They are just best in their approach”

Ramen Dsouza, Student MBA, USA

“They have some of the best USA experts to provide capital budgeting Assignment help online and also help me in my online exams.”

Bob Marlyn, Lancashire University, UK

“Best place to get all help in Capital Budgeting Essay and Exams. Will definitely recommend to all”

Methods of Capital Budgeting Assignment Help

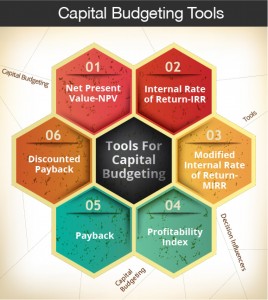

Net Present Value Method Capital Budgeting Assignment Help

This is considered as one of the best method for Capital Budgeting Analysis. This method compares the Net Present Value of the Investment i.e. Present Value of all Current and Future Cash Flow Benefits Less Present Value of all Future Cash outflow Expenses . NPV techniques considers the time value of money and it constitutes addition to the wealth of shareholders. Since all cash flows are converted into present value, different projects can be compared on NPV basis. However NPV and ranking of project may differ at different discount rates, causing inconsistency in decision-making. Following decision criteria is followed in NPV techniques, NPV is equals to present value of cash inflows as a subtracted by present value of cash outflows.

- If NPV > 0, then the investment decision is financially viable.

- If NPV < 0, then investment decision is not financially viable.

- If NPV= 0, the investment may be viable for non-financial considerations.

Internal rate of Return (IRR) Capital Budgeting Assignment Help

IRR is the discounting rate at which Net Present Value of the Cash Flow is Equal to the Current Investment. It is a discounted at the rate at which NPV is zero or profitability index is equal to 1. This technique uses time value of money concept into account while making financial decisions concerning investments. All cash inflows of the project, arising at different points of time is considered and decisions are immediately taken by comparing IRR are with the cost of capital. However IRR techniques are tedious to compute and it will conflict with NPV in case inflows and outflows patterns are different in alternative proposals.

Profitability Index Method (PI) Capital Budgeting Assignment Help

Profitability Index Method is derived from Net Present Value Method. PI method is the ratio of Present Value of Future Cash Flow Benefit and the the present value of costs. If the Results is greater than 1, than Investment is viable.

Accounting Rate of Return Capital Budgeting Assignment Help

Accounting Rate of return is the simplest method of Capital Budgeting Analysis. It is defined as the average rate at which an asset can generate economics and cash flow benefits over its economic life. It is a technique which establishes the relationship between the investment made in the project and profit made on from the project. It is computed with the help of following formula.

ARR = average profit after taxes / investment made in the project x 100

There are following 2 approaches in which the investment made in the project can be ascertained.

Approach 1,

According to this approach, the investment made in the project is taken equal to the amount of initial investment.

Approach 2,

According to this approach of the investment made in the project is computed with the help of following three steps.

Step 1,

Compute opening and closing balance of investment each year.

Step 2,

Compute average of opening and closing balances of the years.

Step 3,

Compute averages of various averages.

For example,

A project requires investment of $ 100,000 and its salvage value after five years will be $ 10,000. In this case, as per approach 2, the investment made in the project is computed as follows.

Years opening balances closing balances average

1 100000 82000 91000

2 82000 64000 73000

3 64000 46000 55000

4 46000 28000 37000

5 28000 10000 19000

275000

Investment made in project is equal to $ 275,000 divided by five years = $ 55,000.

Alternatively the investment made in the project can be computed with the help of following formula,

initial investment + salvage value

2

$ 100000 + $ 10,000

2

= $ 50,000.

Payback Method Capital Budgeting Assignment Help

Payback Method is the period in which Investment will be recovered. For Capital Budgeting Analysis, two or more Projects are compared and the project which has a shortest payback period is selected. However this method is not preferred by economist and investors as this method does not take into account time value of money and also it may happen that some project may not give high return in initial years but can give very high return in later years. Payback means the time limit within which the investment made in the project is recovered. There are falling to situations in which the payback period may be required to be computed.

- Equal future and will cash inflows.

- Unequal future and will cash inflows.

In equal future cash inflows the payback period is computed by dividing and will cash inflows by investment made in the project. However in unequal future cash flows the payback period is computed with the help of cumulative amount of cash inflows.

Example 1,

Suppose a project requires investment of $ 50,000 and it will produce cash inflows of $ 15,000 each year for five years. In this case payback period is computed as below.

Payback period = initial investment made in the project \ annual cash inflows

Therefore, payback period would be = $ 50,000 \ $ 15,000

that is, 3.33 years.

Thus, the initial amount of $ 50,000 invested in the project will be recovered in 3.33 years and the recovery rate of $ 15,000 per year.

Unequal future amount of cash inflows

in this case the payback period is computed with the help of cumulative amount of cash inflows

Example 2,

Suppose a project requires investment of $ 50,000 and it will produce cash inflows of $ 20,000 each year for first two years, $ 25,000 for the third year and $ 40,000 for the fourth year. In this case before computing the payback period we are required to compute cumulative amount of cash inflows in the following manner.

Year cash inflow cumulative product

1 20000 20000

2 20000 40000

3 25000 65000

4 40000 105000

Payback period = 2 years + ($ 10,000 / $ 5000)

Discounted Payback Capital Budgeting Assignment Help

In discounted payback period we use discounting techniques to compute payback period.

For example,

Suppose a project requires initial investments of $ 50,000 and it will produce cash flows of $ 25,000, $ 20,000, $ 30,000 and $ 22,000 for next four years. Assuming discount rate of 10%. Discounted payback period would be as follows.

Year present value of cash flow cumulative amount

1 25000 x 0.909 = 22725 22725

2 20000 x 0.826 = 16520 39245

3 30000 x 0.751 = 22530 61775

4 22000 x .683 = 15026 76801

Discounted payback period is equal to, 2years + 10755 / 22530 = 2.5 years.

Therefore initial investment of $ 50,000 made in the project will be payback to its owners in 2.5 years.

We, at Assignment Consultancy can provide help in all kinds of Capital Budgeting Homework Help. Experts at Assignment Consultancy can also help you in writing a High Quality Capital Budgeting assignment help Report after analyzing and solving the Case Study of Capital Budgeting Analysis.

Click here to get help from best experts.You can read more about Accounting Homework Help service here.