Finance Assignment Help Online: Get Expert Support

Looking for Finance assignment help online, you are at correct place. Finance is the core of any business. It becomes very tough to define finance in one word. Various topics such as Foreign Exchange Management, Decision making, Risk management etc., all comes under the term Finance.

Looking for Finance assignment help online, you are at correct place. Finance is the core of any business. It becomes very tough to define finance in one word. Various topics such as Foreign Exchange Management, Decision making, Risk management etc., all comes under the term Finance.

We would try to define the term Finance in a simpler manner so as to help our students to understand it in a simpler and better manner so that it will help you to understand your finance homework in a better way.

Finance in simple terminology means arrangements and management of necessary funds which is required by organizations like firms, Individuals or big corporations for achieving their objectives.The study of investment on any business organizations is term as finance. The main role of finance is to price assets based on their risk level and their expected rate of return. It includes the dynamics of assets and liabilities over time under conditions of different degrees of uncertainty and risk, it is also known as the science of money management.

We at assignment consultancy believe in providing best finance assignment help online to the students with our experienced experts and best customer services. We have the pool of 5000 extremely qualified experts serving students regularly on a full-time basis.

Services We Offer

Finance Assignment Help Online at Assignment Consultancy

Assignment always put student on worries and stress. But with Assignment Consultancy for your help, you can select any of our popular services and remove all your worries here.

- Project Finance Case Studies Help

- Finance Online Exam Help

- Balance Sheet Analysis Homework Help

- Activity Ratios Financial Assignment help

- Performance Ratios Analysis Finance Assignment help

- Activity Ratio Assignment Help

- Market Based Ratio Analysis Assignment Help

- Profitability Ratio analysis Assignment Help

- Financial statement analysis case study assignment help

- Finance MBA assignment help

- Economics assignment help

- Statistics assignment help

- Business Plan assignment help

Why Select Us

Finance Assignment Help Online Features

We believe in providing no plagiarism work to the students. All are our works are unique and we provide Free Plagiarism report too on requests.

Our customer representatives are working 24X7 to assist you in all your assignment needs. You can drop a mail to assignmentconsultancy.help@gmail.com or chat with our representative using live chat shown in bottom right corner.

We are the only service providers boasting of providing original, relevant and accurate solutions. Our three stage quality process help students to get perfect solutions.

All our works are kept as confidential as we respect the integrity and privacy of our clients.

Referral Program

Refer us and Earn up to 5000 USD

Place Order and generate unique Code

Whenever you make a payment. You are eligible for a referral code, just request in email so that you will get the code which you can share with your friends.

Earn Money

You will be eligible for referral bonus if your friend place the order using the same referral code using no other discounts after successful payment made by him.

Encash it or Use it in your next assignments

You can request the encashment as mentioned in step 2 or you can use it as a method of payment for your next assignments.

Importance of Finance Assignment Help Online

Help in Understanding Financial Information

Finance is concerned with gathering, inspecting and connecting financial information. This information is beneficial for those who need to make judgments and strategies about businesses, comprising those who need to control those businesses. For example, Financial information may be needed for the following purposes:

- For development of new products or services, such as new range of computers by an existing manufacturer.

- For fixation of prices and quantities of new or existing products or services, such as tariff plan changes by a telecommunications business.

- Borrowing money, such as a shopping mall or supermarket wishing to increase the number of stores.

- Adjusting the operating capacity of the business, such as a cola making business changing its production during winters.

Other than managers financial information is also desired by stakeholders and other groups external to the business. These external groups need information for making important financial decisions.

Helps in Identifying Users of Financial Information : There are different users as given below:

Consumers, Whether to take further goods or services offered by the, involving an valuation of company’s ability to continue in business and to meet their needs, particularly in respect of any after sale services claimed.

Competitors, Whether to compete against the competitor or to leave the market on the grounds that it is not possible to compete profitably with the competitor.

Government, is apprehensive with gathering of taxes and duties, thus it requires financial information about the company to assess whether due taxes are paid by the in time. Government also need financial data from across industries to publish periodicals and budgets.

Suppliers Whether to continue to supply and, if so, whether to supply on credit. This would involve an assessment of company’s ability to pay for any goods and services supplied.

& others, such as, lenders, managers, owners etc.

Helps in balancing Risk & Return

Decision making is looking into future courses of actions now by choosing from various available alternatives. Future is unpredictable as always and business decisions are no exception. While making the decisions we evaluate the available alternatives and choose the best course of action to be executed in the future. Hence there is a great deal of risk in business decision-making as future is unpredictable. It is also well known that there is a direct relationship between risk and reward. Understanding the basic relationship between risk and reward is important for setting financial objectives and goals of the business. It is well-known that higher the risk higher will be the rewards. Owners will desire a minimum rate of return on their investment and an additional return to satisfy the stakeholders. Those to manage risk and return managers shall understand the financial information deeply so that accurate and correct financial decisions can be made and implemented.

The following are common risks related to personal and financial decision making:

- Personal risks – Personal risk may be in the form of embarrassment, humiliation, shelter, or wellbeing concerns.

- Inflation risks – inflation reduces the purchasing power of money and therefore increases the prices of commodities.

- Interest-rate risk – makes borrowings expensive as more interest needs to be paid.

- Income risk – changing the path of career or current job sometime results in a lower income of an individual. Therefore change in career or job loss results in lower income and lower purchasing

Helps to make strategic business decisions

Strategic decisions are decisions making at the highest level of management hierarchy in the company by top shots such as the CEO, Directors or Board members. They decide the path of the company over future months and years. Decisions made by the top line has wider consequences in comparison with the management decisions made at the middle or lower levels of the management. Thus strategic decision-making is a cumbersome process which requires in-depth knowledge of the financial information on the premises of which strategic business decisions are to be made. Strategic business decisions affect the outcome of a business directly. To strengthen its position in the market strategic decision-making is an important activity to be carried out effectively. There are ways in which market position and growth of the company can be regulated such as,

Organic growth – organic growth means expansion within that is developing the product base of the company by developing more product lines or exploring new markets to get business. Organic growth is all about looking into our own strengths and making progress on them. for example, new products and new geographical markets, such as overseas or new distribution channels.

Inorganic growth – implementing takeover or merger strategies to grow vertically.

Finance Assignment Help Online Categorization

Finance is a very vast and broad area and therefore it is majorly classified into large no. of fields as given below. We have experts to help you in each of these major categories. It covers a wide part in the area of business. Different activities are involved to run a business and finance has the major impact on such activities. Areas of businesses like marketing, operation technology, and management all are interconnected with finance that you can include in your accounting and financial management assignment writing. In order to run their business efficiently, business owners and business managers should have a basic understanding of finance assignment help. Students require finance assignment help Online in three main areas of finance that colleges and universities involve following courses as follow:

Personal Finance Assignment Help Online

It basically deals with financial planning at the individual level. It covers wealth planning, tax planning, wealth transfer, retirement planning etc. for an individual. It is done by keeping in mind personal preferences, Goal and Risks preferences of an individual. We have some of the best experts to provide you best personal finance assignment help online. You can read more about our Personal Financial planning Assignment Help here.

Corporate Finance Assignment help Online

Corporate finance deals with financial planning at the corporate level. It covers capital structure management, the arrangement of the fund, tax structure, future expansion strategies, valuations etc. When a company is about to make decisions on the financing and investment activities, corporate and business finance reflects the actions of the company. They have to find a way to pay for it, whenever a firm buys something. That means there has to be a finance related decision. You will understand it deeply with our finance assignment help.We have some of the best experts to provide you best corporate finance assignment help online. You can read more about our Corporate finance assignment help here.

Financial Services Assignment Help Online

It basically deals with various financial services calculation and assignments like Annuity calculations, future payback etc. It is one of the most used and applicable finance categorizations among all the services.

Behavioral Finance Assignment Help Online

It basically covers the theoretical aspects of various behaviors related to different financial decisions. It encompasses various decisions to justify the behavior of individuals after a particular financial decision.

Investments Finance Assignment Help Online

Various business venture most often a large business, makes investing in assets. Business firms invest on assets can be short-term securities such as marketable securities or may be of long-term securities like stocks and bonds. Their main purpose of the investment is to gain profits on the investments. You can gain more information or proper guidance with the help of our finance assignment help experts, who are Ph.D. qualified finance writers to write authentic quality accounting and finance management assignments.

Finance markets and instructions Assignment Help Online

This is the most important area including above two, where students need finance assignment help online. The main action of the financial markets is, it plays a medium between the servers of fund and users of the fund. It acts as a platform for the people and entities to trade financial securities and commodities. In this users are classified as the business and government where as savers are classified as households. Stock and bond markets, the primary and the secondary markets and the money and the capital markets are the examples of the finance markets. At our accounting and finance assignment help, we provide deeper insight into these aspects so that you can write accounting and financial management assignments. We are available 24/7 for any of your finance assignment help queries. A financial institution works according to the financial markets and helps to make the transfer of funds and between users and savers. For example, an individual might deposit money into a savings account. Then, the financial institution would take that money and loan it out to a business. If you are looking for finance homework help, then you can go for our finance assignment help online so you can get the best assistance on writing accounting and financial management assignment.

Why Student Needs Finance Assignment Help online?

Every students come with different intellect power, everyone one cannot have the same brain or come up with good quality accounting and financial management assignment therefore we are here to provide every student a wide range of accounting and finance assignment writing services, so that every student can get the benefit and will able to build his/her finance assignment writing skill. Finance writing assignment help is provides by our highly qualified experts of PhD level who are capable of writing best accounting and finance management assignments. This is why various students prefer us for their finance homework help.

Basics For Finance Assignment Help Online

In this section we will discuss some of the most popular basics regularly asked in theory, numerical, report etc. so as to provide some help to the students looking for finance assignment help online.

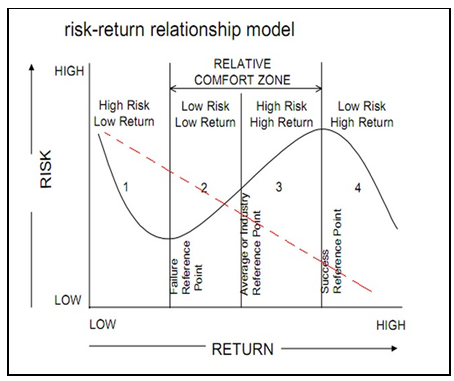

Risk- Return Relationship

Understanding the relationship between risk and return would be of interest to any investor since each one of us would be interested in making a high return out of a low-risk proposition. To study the relationship between risk and return means to study the effect that changes in one would have on the other.

Direct relationship between risk and return

High Risk – High Return

Under this type of a relationship, when an investor takes a certain amount of risk the returns would be higher when higher amounts of risk are undertaken. One way of looking at it would be, ‘the higher the amount at risk, the higher would be the return. For example, if an investor invests one million dollars at 10% return, his risk is the loss of losing one million dollars and his return would be one lakh. If he invests an additional one million, his risk of loss increases to two million now, but his return also increases to two lakh.Mathematically speaking, the risk is measured as the standard deviation in return. Following is the formula for the same

Risk=Return-Mean of return/√Number of values considered

Now the higher the return value in this formula, the higher would be the risk, which again highlights the direct relationship between the two

Low Risk – Low Return

There is also a direct relationship between the lower risk and lower return in the same way as the above. When the investor decreases his investments in a certain product, his amount at risk also falls and thus his risk decreases.

Negative Relationship between risk and return

The above given model or the relationship has sometime, also been noted as being negative. Following sections would explain the relation:

High Risk and Low return

Sometimes, due to the nature of the product, the higher risk may not translate into higher returns. Even if you take higher risks, your returns might remain the same. For example, in the case of a game of lottery, if you buy one ticket, the prize will remain the same as it would if you buy 50 tickets. Therefore, there is no direct relationship between risk and return in this case. Even if you buy all the lottery tickets, the prize that you would finally get would still remain the same would not increase with your increasing amount at risk that you invest.

Low risk High return

There are various investments that you would face which will give you higher return and low risk. For example, let’s consider that the government of some country needs money in urgency. Because the government needs money in an emergency and thus gives a high return on small investment. When one gets such an opportunity to invest in low risk and high return proposition, you should surely invest to get higher returns on low risk.

Concepts of Efficient Capital Market

One more popular topics, regularly asked by the student to get finance assignment help online. Efficient capital markets have long been a major area of study in financial research. The concept of efficient market hypothesis lies in the belief that the capital markets are ‘informationally efficient’, which means that the prices of financial assets reflect information that is relevant to affect the prices of the products. This implies that due to the fact that continuous miss-pricing of products is absent, there is no possibility that accurate predictions can be made all the time to make assets outperform the markets. This means that there is no possibility of generating returns that are higher than the average performance of the market, but with taking additional risks.

Basic Concepts

The concept behind efficient capital markets is more than straightforward and highlights the fact that if the price of a certain asset is lesser than it should be, on the basis of information that is available in the market, investors have a good chance of making profits by using arbitrage strategy of buying the security now and selling it after correction happening. This correction would happen since prices would automatically be pushed up due to the fact that the asset would no longer remain underpriced. Similar to this, if the asset prices were more than what market information expected them to be, they would be automatically pulled down.

Efficient market Types for Finance Assignment Help

When dealing with it technically, efficient markets take three forms, the first known as the weak form is based on the principle that future prices of securities of asset prices cannot be predicted from historical information that the market supplies of the given assets or stocks. Putting it in other words, the weak form of capital markets’ efficiency suggest that the stock prices follow a random walk and are based on Random Walk model rather than being based on past prices of stocks and that a study of past prices of stocks cannot be used to make correct judgment of future stock prices.

The second form of efficient markets, known as semi strong form of efficient markets supports that capital market immediately reacts to any form of public information about a stock and that the market neither overreact or under react to a particular information about any stock in the capital market.The third form or the strong form of the efficient capital market philosophy says that the markets immediately imbibe into the stock prices, not only the public information available but also any private information that is new.

Putting it in other words, the one thing that efficient markets hypothesis does not stand for is the fact that no one can make profits from adjustments in prices of stocks in the capital market. The investors who react to the correction quickly without too much time after the prices begin to react to the situation would necessarily get benefitted because they have informational and execution advantages in doing so and that would in fact not be inconsistent with the efficient market hypothesis theory.

As far as empirical evidence for the efficient market is concerned, it has given mixed results and out of the three forms of the market, the strong form has been consistently refuted. Researchers of behavioral finance are working to file where and how the efficient markets hypothesis does not stand true and which are the situations where the hypothesis has been partially predictable. Apart from this, the concept of capital market efficiency is challenged by behavioral researchers on basis of cognitive biases that would become a basis of investors’ irrational behavior and limits to arbitrage opportunity by the investors that would prevent others from taking advantage of this cognitive ability of the human mind.

Sources of Long Term Fund Finance Assignment Help Online

Businesses need long-term funding for acquiring assets, executing R&D projects, enhancement, and expansion. Major methods for long-term financing are as follows:

- Equity Financing

Equity financing is one of the major sources of long-term funding available to a business it includes stocks that this common stocks and preferred stocks. In contrast to the loan, capital stocks are less risky as there is no fixed rate of return commitment to the stockholders. Having said that equity financing shares the ownership, control, and earnings amongst stockholders and result in a dilution of ownership. Usually, the cost of equity is higher than the cost of debt.

- Corporate Bond

Corporate bonds are issued by the company to raise money from the public to be used in the business expansion programme. Bonds are long-term instruments and carries a fixed rate of interest which business must pay to the holders thus puts extra pressure on the company to earn more to satisfy the bondholders’ expectations. Bonds are usually issued a period of more than one year.

Popular Topics and Approach

Few popular topics that are asked regularly by the students related to finance and accounts assignment help are explained below. You can navigate to each of these pages to understand the rational behind each of these topics.

Other Finance Assignment Help Online Topics at Assignment Consultancy

Assignment Consultancy provides finance homework help in all categories as mentioned above. Some of the special topics where we provide services are as follows:-

These are just a few broad areas as we provide services nearly to all topics come under finance management.

Popular Finance Assignment Help Online Topics

The topics on which we receive regular requests from the students to provide help are as follows:-

Important Concepts for Finance Assignment Help Online

The various concepts that help us in providing finance homework help to the student are as follows:-

- The most important concept of Finance assignment basically deals with saving and investments. Sometime Finance also includes lending money or capital.

- Money or Marketable Securities which can be readily convertible into cash is an indispensable token in many finance assignment help online questions asked to us.

- Most Finance assignments are determined by three factors i.e. Time, risk and capital.

- The entire concept of many finance assignment helps online starts with Banks as they are the supreme institutions who grant money in the form of ‘debt to various individuals as well as big corporations for the purpose of consumption and investment decisions.

- The whole process of many corporate finance assignments has the common conclusion i.e. whatever money has been given by the Banks or various other institutions will lead to the generation of interest, i.e., major revenue earned by financial institutions in the form of Interest.

- Finance assignments also include Hedging, Money Market Operations as well as various other models such as valuing the price of Bond, Share, and Debentures etc.

- Many financial management assignments also include one of the most important analyses of Ratios. The modern concept of Finance evaluates the company by doing Ratio Analysis which helps the corporations to know the Financial Stability of the company. An example of Such Ratio Analysis is Economic Value Added. It helps in knowing the excess of return of the company over and above the cost of capital of the company.

Sample Questions Asked for Finance Assignment Help

We received thousands of numerical and theoretical questions related to Finance and Accounts. Some of the common questions asked and our approach are explained below:-

What do you understand by the term Prepaid Expenses?

Prepaid Expenses are the expenses which have been paid in advance and this expense does not accrue in the Current year of preparation of Financial Statements. Prepaid expenses do not affect the Income Statement in the Current year of preparation of Financial Statements and are generally shown as an Asset in Financial Statement. Prepaid Expenses can be explained with the help of an Illustration:

A Corporation preparing a Financial Statement for the year Jan1-Dec31 has made a payment of one time Telephone Bill at the month of July 1 for $50000 for 1 Year. In the present case, Telephone Bill payment of $50000 includes $25000 for the Year Ending December 31 and another $25000 for the next Year. This means an amount of $25000 does not accrue in the current year and it will be recorded as a prepaid expense. To record a Prepaid Expenses, the following Journal Entry is passed:

| Serial No | Entry | Debit ($) | Credit ($) |

| 1 | Prepaid Expenses A/c | $25000 | |

| To Cash /Bank A/c | $25000 |

This Entry will have two Effects on the Following Item in Balance Sheet:

- It will create a New Asset in Balance Sheet as Prepaid Expense of $25000

- It will reduce the Cash/Bank Balance by $25000.

What is the Meaning of Net Income/Net Loss?

Net Income refers to the difference of all Income and Expenses. If the difference between all Income and Expense is positive, it is referred to as Net Income and if the difference is negative, it is referred as Net Loss. Net Income is also commonly known as Net Earnings. The basic purpose of doing accounting is to calculate the Income/Loss of an entity.

What do you understand by the term Cost of Sales in Finance & Accounting?

The cost of sales is the cost of the Goods sold by the manufacturer during the year. The cost of sales Calculated by adding Cost of Finished goods in the opening stock plus the cost of goods manufactured during the year less Cost of the finished goods lying in the inventory at the end of the year.The cost of Sales does not include any kind of selling expenses or any kind of administrative or general expenses.

What is meant by Long Term and Short Term finance requirements in Business?

In business, long term period implies a period which is more than one year and may extend up to 5 years whereas a short-term period is relatively small and is restricted to the maximum of 90 days. Depending upon the size and nature of business long-term and short-term requirement of businesses may differ usually businesses are seen as going entities with no intention of closure in the near future. Thus investment in assets for manufacturing the products is an essential long-term requirement of the business whereas for running day-to-day operations business needs funds which come under short-term requirements of the business such as working capital.

The capital structure of a business is composed of owner’s capital and loan capital. The loan capital is acquired from the lenders for a long period of time to support the financial assets and operations of the business. The cost of loan capital is fixed rate of interest which needs to be paid to the lenders whereas for managing day-to-day affairs of the business working capital is needed which is an excess of current assets over and liabilities.

The expansion is a key concept followed by every business available in the universe. Expanding the horizons of business is also one of the key strategic decisions which must be fulfilled besides other objectives. Thus issuing securities bearing fixed rate of interest is essential and comes under long term business requirements of the business whereas putting money into the debtors or stock or other current assets becomes the need of the business for running operations profitability and comes under short-term requirements of the business.Thus, both long-term and short-term requirements are integral and essential to the business.

What are different types of Business Ownership?

There are basically three types of business ownership, namely

1. sole proprietorship

2. partnership

3. limited

These are some of the common questions asked. We provide the best help for numerical as well as theoretical questions. Our clients are from all over the World.

Looking for finance assignment help online service. Please submit your assignment here.

Comments are closed.